CuriosityStream (CURI) Sophon Profile

A microcap streaming company with licensing momentum but limited visibility

Since launch, our goal with Sophon Microcap Atlas has been to build the definitive research hub for underfollowed sub-$500M companies.

Each month we’re adding deep-dive coverage, proprietary scoring frameworks, and differentiated insights you won’t find anywhere else. With every report, the value of the platform compounds — but so does the subscription price.

We’ve structured it this way deliberately: to reward early adopters who believe in what we’re building. Subscribers who joined at launch are still paying their original rate, and they’ll keep that price for life. By contrast, new readers coming in today are already paying more than they did six months ago.

That’s by design. We’re investing heavily in research, and we want to keep the economics aligned with our most loyal readers.

When you join Sophon Microcap Atlas, your subscription price is locked in for life. We raise rates by $15 every two months to reflect the growing value of our research library, but early subscribers keep their lower rate forever. On November 1, the price rises to $60/month or $540/year — lock in now at $45/month or $400/year and you’ll still be paying that rate years from now, even when the service is worth thousands.

Disclaimer: Not financial advice

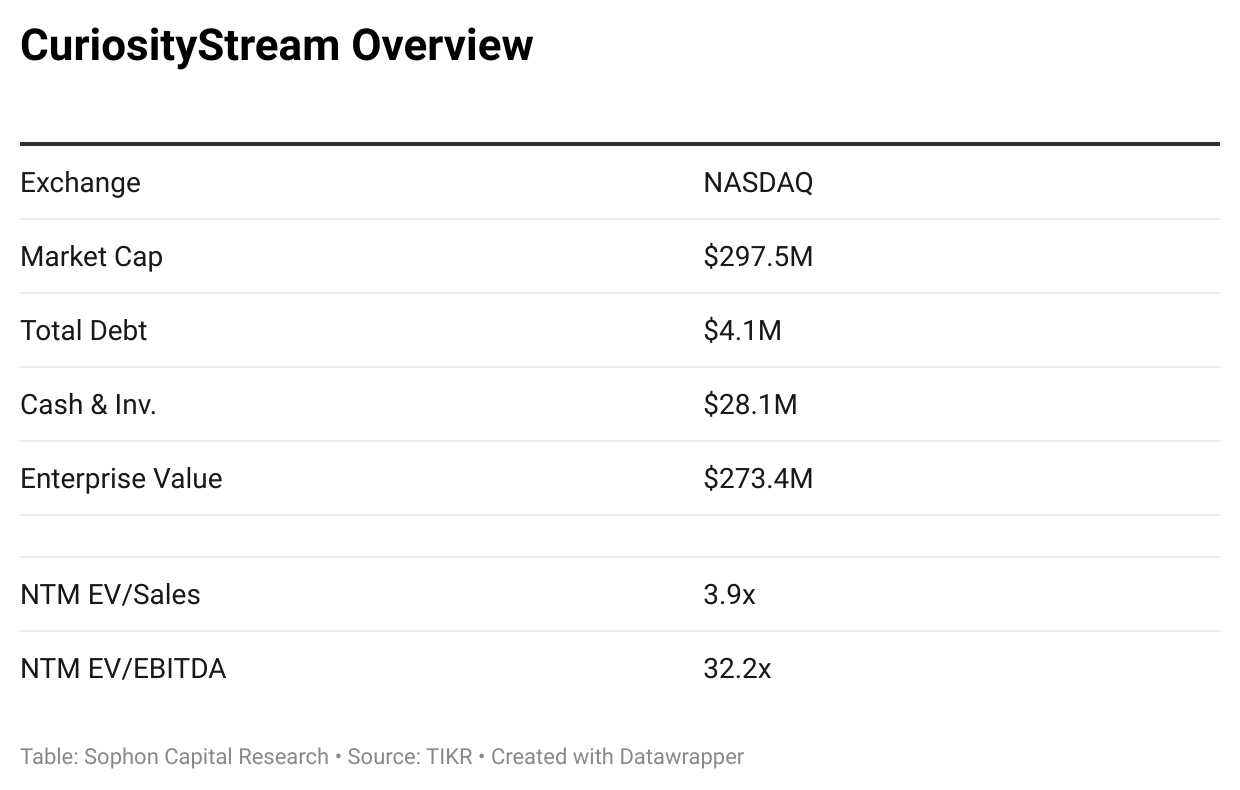

View: Pass

Sophon Score: 51/100

In the end, CuriosityStream feels more like a company that has bought breathing room than one that has built a lasting business model. The licensing push is bringing is generating cash, but cash flows look uneven, the contracts are short, and the reliance on partners leaves economics outside their full control.

The dividend sends a good signal, but it’s hard to see it as sustainable if growth slows. On top of that, the lack of transparency and the unresolved rules around AI rights make it tough to get comfortable with the name. For now, the stock is interesting, but not one we’re ready to back with capital or include in active coverage.

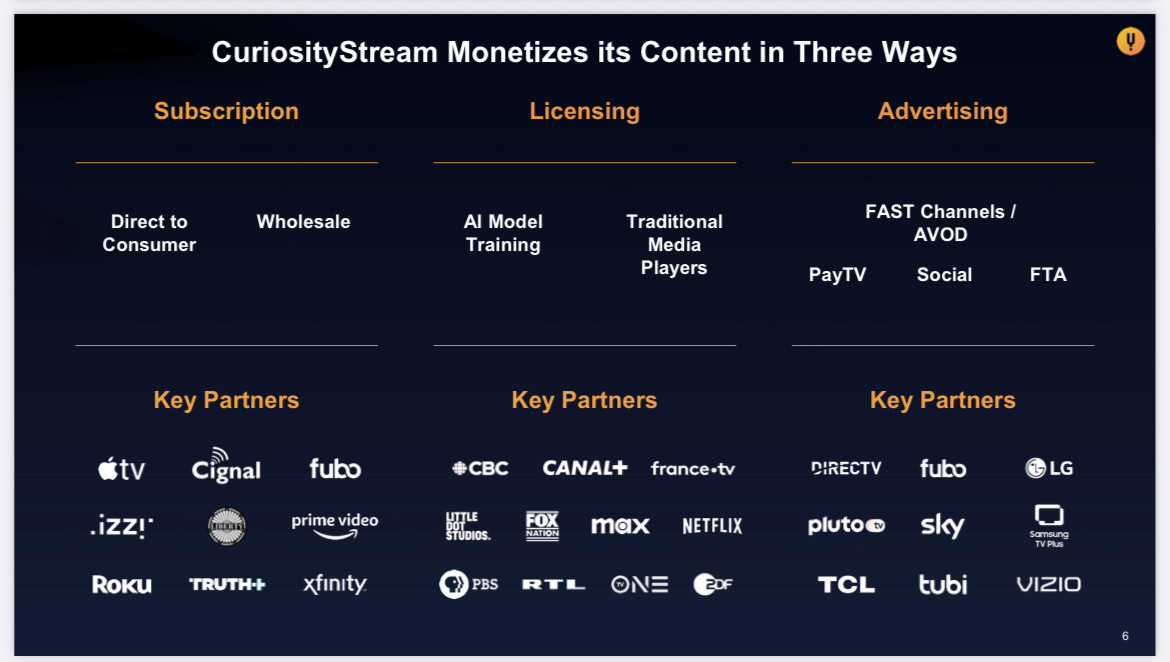

CuriosityStream (CURI) is a factual and educational media company. It distributes its content — documentaries and factual series — through three main channels:

Direct-to-consumer (DTC): Its SVOD app allows consumers to subscribe directly.

Wholesale / Partner distribution: It sells access through platforms like Prime Video Channels, bundles (Comcast, Sling, YouTube TV), and international distribution partners.

Content licensing: This includes traditional licensing of its library to other media companies and, increasingly, AI/data licensing — where its content is used to train AI models or generate structured datasets.

In simple terms, CURI generates revenue from subscriptions, selling content to other companies, and licensing data for AI, all while keeping costs relatively lean by leveraging a rights-cleared content library instead of producing expensive originals.

CuriosityStream has always been a somewhat unusual animal in the media landscape. Born as a DTC niche streaming service, it sought to occupy the educational and factual (ie documentary or reality TV) corner of the content universe while competitors spent heavily on scripted and sports. That original strategy produced modest subscriber traction but also heavy cash burn, leading the company into what looked like a spiral: rising content obligations, negative operating leverage, and questionable strategic optionality.

Yet in the past two years, mgmt has executed a notable pivot away from pure DTC toward licensing and data-driven monetization of its large factual content corpus.

This repositioning has been enough to stabilize FCF, fund dividends, and draw renewed investor attention. On paper, it creates the outline of a turnaround story.

Keep reading with a 7-day free trial

Subscribe to Sophon Microcap Atlas to keep reading this post and get 7 days of free access to the full post archives.