eBay (EBAY) Initiating Coverage

eBay offers a compelling risk-reward set-up and is a buyback machine

This post was published prior to this platform’s re-branding as Sophon Microcap Atlas (with an exclusive focus on sub-$500M market cap companies). Coverage of EBAY is moving to our sister publication - AlphaArk

We have initiated a position in EBAY in our model portfolio , and as a standard disclaimer are noting that nothing written below represents investment advice. Please consult your fiduciary prior to making any investment decisions.

eBay Inc. (EBAY) stands out as a compelling value investment in our view with a favorable risk-reward set up. We value the stock with a bull case 2-year price target (PT) of $125 and a bear case PT of $51, suggesting ~92% upside and ~22% downside - for a R/R of ~4:1.

This write-up is shorter than our standard initiating coverage reports, as the thesis is quite simple. eBay is driven by a high-margin, asset-light model and accelerating growth in enthusiast-focused categories. It sports 70+% gross margins, a massive buyback program, and a particularly strong brand. Annual GMV/revenue have been down in recent years, which feeds a pessimistic narrative on the name, driving a lack of “hot money” flowing into the stock. Recent quarterly GMV levels, however, appear to have stabilized. Even with zero/LSD top line growth in the business, and slight multiple contraction (EBAY already trades at a meaningful discount to comps), the stock has significant upside as a result of equity shrink. At its current valuation, the stock has an embedded free call option on future monetization opportunities—such as financing, insurance, or loyalty programs.

Secular tailwind: Recommerce (resale of used/refurbished goods) is growing faster than overall retail, driven by younger consumers’ comfort with secondhand, sustainability pressures, and price sensitivity.

Margin structure advantage: Unlike competitors building recommerce through logistics-heavy models (ThredUp, The RealReal, or even Amazon Renewed), eBay doesn’t touch inventory. It captures recommerce volume at much higher incremental margins.

Category expansion: Recommerce has moved well beyond apparel into electronics, auto parts, collectibles, and luxury goods — all categories where eBay has historical strength and credibility. This breadth allows it to capture share across multiple verticals, not just fashion.

Network effects intensify: As recommerce supply grows (sellers listing idle goods) and demand grows (buyers looking for cheaper or sustainable options), eBay’s marketplace flywheel accelerates. More liquidity attracts both sides, reinforcing defensibility versus niche startups.

eBay is structurally advantaged in downturns because its core business aligns with consumer trade-down behavior. As households tighten spending, they shift toward secondhand, refurbished, and lower-priced goods. eBay owns that category at global scale, unlike Amazon or Walmart, which are largely tied to new-goods retail. Importantly, eBay doesn’t take inventory risk. Its take-rate model lets it monetize volume, even if average selling prices fall. On the supply side, tougher times push more sellers to list, boosting marketplace liquidity. Combined, this creates a countercyclical dynamic: softer consumer environments can accelerate engagement, widen the value gap with competitors, and deepen eBay’s defensible niche in resale.

In the current soft consumer backdrop, eBay could work as a relative winner in retail/e-commerce. The stock benefits from multiple near-term drivers:

Buyers shifting toward value categories (used/refurbished) where eBay has unique share.

Sellers increasingly monetizing idle goods, expanding inventory at no cost to eBay.

Marketplace model insulating margins compared to inventory-heavy peers exposed to markdowns.

Add to that a disciplined capital return program (buybacks/dividends) and stable free cash flow, and eBay offers downside protection with potential multiple expansion as investors seek “defensive growth” within consumer internet.

Moat & Competitive Dynamics

EBAY has a massive and under appreciated moat as sellers have built their reputations (i.e. ratings) on the site during its multi-decade history.

It is dominant in its niche and faces little risk of market share loss to other e-commerce giants. Amazon excels at common SKUs - for example, buying a 24-pack of 12 fl ounce Coca-Cola cans. However, if you were looking to buy 2008 Beijing Olympics-themed Coca Cola cans, you can only find them on eBay.

In other words, eBay thrives precisely where Amazon falls short. When seeking a generic consumer good, shoppers instinctively turn to Amazon. However, when the search revolves around unique, rare, or vintage items such as an out-of-print book, a collectible, or a discontinued product, eBay becomes the platform of choice.

eBay’s development of its own payment platform following the 2015 spin-off of PayPal stands as a pivotal yet underappreciated move that enhances the company’s long-term growth and moat. After initially relying on PayPal to process payments under a transitional services agreement, eBay began shifting to its managed payments system in 2018, completing the transition by 2021. This shift has allowed eBay to regain control over a vital part of its ecosystem, driving profitability and strengthening ties with its users, all while creating a meaningful growth opportunity for the business.

By managing payments in-house, eBay now retains a portion of the transaction fees that once went to PayPal, directly increasing its revenue per transaction. Historically, eBay’s take rate—the percentage of GMV it keeps as revenue—has ranged from ~8-10%. With its payment system, eBay adds an additional ~2-3% in processing fees, depending on the market and category, without altering its core marketplace model.

In 2023, 90+% of eBay’s GMV flowed through this system, contributing to improved operating margins. Across its $70+ billion annual GMV, this incremental revenue stream transforms what was once a cost into a scalable profit center.

Beyond financial gains, the payment platform bolsters eBay’s operational edge. Controlling the transaction process provides eBay with deeper insights into buyer and seller behavior, fueling better marketing, fraud detection, and product development.

This data advantage reinforces eBay’s position against competitors like Amazon and newer marketplaces, while reducing dependence on external partners. Additionally, the infrastructure opens doors to future monetization opportunities—such as financing, insurance, or loyalty programs—without requiring significant new investments.

The market, however, seems to overlook this development’s full potential. eBay’s stock often trades at a discount to peers, reflecting its mature marketplace status and slower GMV growth. Yet, the payment platform’s contribution adds a layer of value not fully recognized, enhancing margins and offering pathways to new revenue. For investors, this presents a compelling case: a stable core business paired with a strategic initiative that quietly amplifies its profitability and resilience.

Our bullish perspective is underpinned by operational efficiencies, a pivot to higher-margin categories, a $3 billion share repurchase program, strategic moves like the Caramel acquisition, AI enhancements, and potential revenue streams from controlling payments. With modest net debt, and a 1.8% dividend yield, eBay offers a rare mix of safety, income, and growth potential.

Investment Thesis

1. Capital Allocation Excellence

eBay’s shareholder focus shines through its 2024 capital returns of $3.7 billion—$3.15 billion in share repurchases (56 million shares at $56.05 average) and $533 million in dividends ($1.14/share). This reduced shares outstanding by ~17% since 2022 (from 560 million to 466 million). From 2015 to 2024, EBAY reduced shares outstanding by ~62.5%.

The Q4 earnings call highlighted $900 million in Q4 buybacks at $64/share and a fresh $3 billion authorization, targeting at least $2 billion in 2025 repurchases. A dividend hike to $0.29/quarter ($1.16 annualized, 1.8% yield) further boosts returns.

At $2 billion annual buybacks, shares could shrink conservatively to ~410–430 million by 2027, lifting per-share value at a ~5-7% CAGR without revenue growth, constant margins, and no change in the valuation multiple. CEO Jamie Iannone emphasized this as a path to “robust earnings growth” in 2025, with non-GAAP EPS already up 15% to $4.88 in 2024.

2. Focus Category Momentum

eBay’s pivot to enthusiast categories—parts & accessories (P&A), collectibles, fashion, electronics, and home & garden—drove 5% GMV growth in 2024, accelerating to 6% in Q4. Trading cards surged double digits, P&A grew mid-single digits for two years, and the Caramel acquisition (announced Q4) targets a ~$75 billion collectible car TAM.

Iannone noted P&A’s 700 million listings and synergies with vehicle buyers spending “thousands” annually on related items. The U.K. C2C overhaul—eliminating seller fees and adding buyer protection—lifted Q4 C2C GMV double digits. Management expects low single-digit GMV growth in 2025, with Focus Categories growth supporting a projected 5–7% revenue CAGR.

3. Innovation and Advertising Tailwinds

eBay’s AI investments—proprietary LLMs 100x larger than 2023’s—powered over 100 million listings via Magical Listing, generating billions of GMV in transactions with ~90% seller satisfaction.

Buyer tools like Shop the Look and Explore enhance discovery, while partnerships with OpenAI and Meta’s Facebook Marketplace expand reach. CFO Steve Priest reported Q4 advertising revenue up 12% to $445 million (2.3% of GMV), with first-party ads accelerating 16% to $434 million, driven by ~1.1 billion Promoted Listings. Management forecasts ad growth as a “key driver” of 2025 revenue, lifting take rates above pre-U.K. initiative levels (13.3% in Q4). These innovations position eBay to capture share in the ~$500 billion collectibles market and beyond.

Financials, Valuation and Return Potential

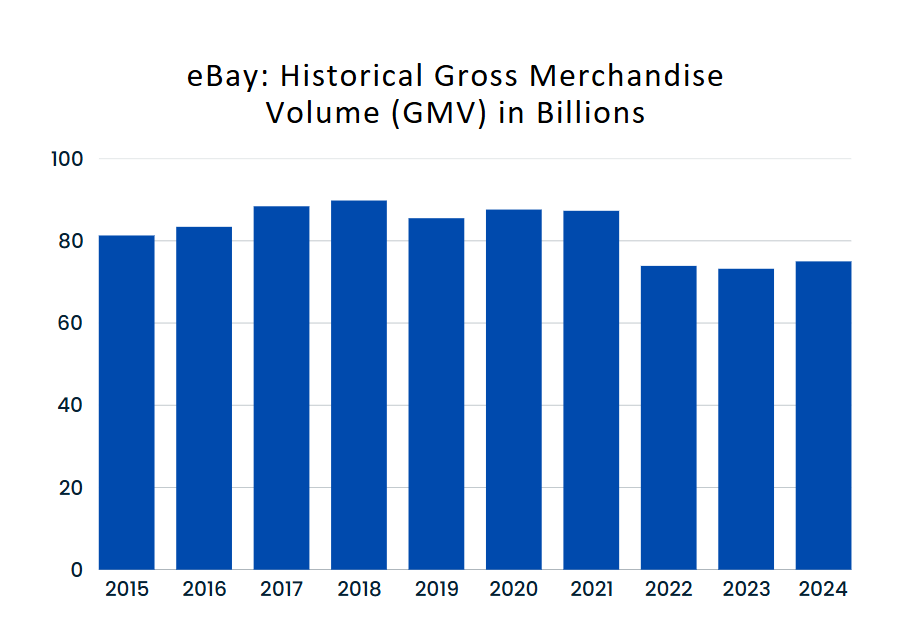

The market is currently bearish on eBay due to stagnating GMV growth (see chart below):

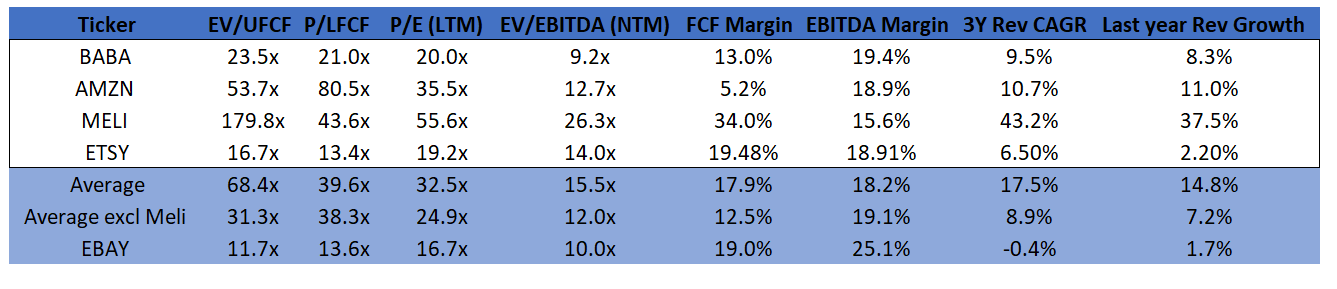

This is reflected in its forward multiple comparable against e-commerce peers (see table below):

Bull Case: 8% revenue CAGR, 22% FCF margins, 18x P/FCF FCF, and 410 million shares results in a PT of $125 (92% total return).

Bear Case: 2% revenue CAGR, 17% FCF margins, 12x P/FCF, and 430 million shares suggest $51 (22% downside).

FY24 free cash flow (FCF) was ~$2 billion, aligning closely with guidance, though 2025 FCF faces $1 billion+ in one-time tax headwinds.

For 2025, management forecasts revenue of $10.5–$10.7 billion and normalized FCF (excluding tax anomalies) above $2 billion, implying a forward EV/FCF multiple of 15.4x at the midpoint—below the S&P 500’s 20–25x and peers like Amazon.

Analyst ratings (9 Buy/Strong Buy, 21 Hold, 3 Sell/Strong Sell) understate eBay’s momentum.

Risks and Mitigants

Competition

Amazon and Walmart consolidate e-commerce share, but eBay’s 40%+ international GMV and non-new-in-season focus (growing faster than new goods) carve a niche. Iannone noted share gains in Focus Categories despite flat U.K./Germany e-commerce.

Macro/Tariffs

Q1 2025 GMV guidance (0–1%) reflects tariff uncertainty, but only 5% of GMV is China-to-U.S., with 75% forward-deployed and tariff-compliant.

Execution

The Caramel rollout and U.K. shipping mandate (Q2 2025) carry risks, though early U.K. C2C success (double-digit GMV lift) and high AI adoption mitigate concerns.

Conclusion

eBay at $65.67 trades at a forward EV/FCF of 15.4x—below market norms. Its ~$2 billion current FCF, Focus Category acceleration (6% Q4 GMV), and AI-driven innovation support a ~92% upside to $125 over the next 2 years.