Innventure (INV) Sophon Profile

Incubator turning corporate R&D into companies, using a unique model

Since launch, our goal with Sophon Microcap Atlas has been to build the definitive research hub for underfollowed sub-$500M companies. Each month we’re adding deep-dive coverage, proprietary scoring frameworks, and differentiated insights you won’t find anywhere else. With every report, the value of the platform compounds — but so does the subscription price.

We’ve structured it this way deliberately: to reward early adopters who believe in what we’re building. Subscribers who joined at launch are still paying their original rate, and they’ll keep that price for life. By contrast, new readers coming in today are already paying more than they did six months ago.

That’s by design. We’re investing heavily in research, and we want to keep the economics aligned with our most loyal readers.

When you join Sophon Microcap Atlas, your subscription price is locked in for life. We raise rates by $15 every two months to reflect the growing value of our research library, but early subscribers keep their lower rate forever. On November 1, the price rises to $60/month or $540/year — lock in now at $45/month or $400/year and you’ll still be paying that rate years from now, even when the service is worth thousands.

Disclaimer: Not financial advice

View: Pass

Sophon Score: 76/100

Innventure has a disciplined model and a strong pipeline, but the company is burning cash at a high rate with only modest near-term revenue, leaving financial health a concern. Its strategy depends on a few “home run” ventures, making returns binary and highly execution-dependent. While the long-term upside exists, the combination of cash burn, pre-revenue risk, and potential dilution outweighs the near-term visibility, so we are passing on the investment.

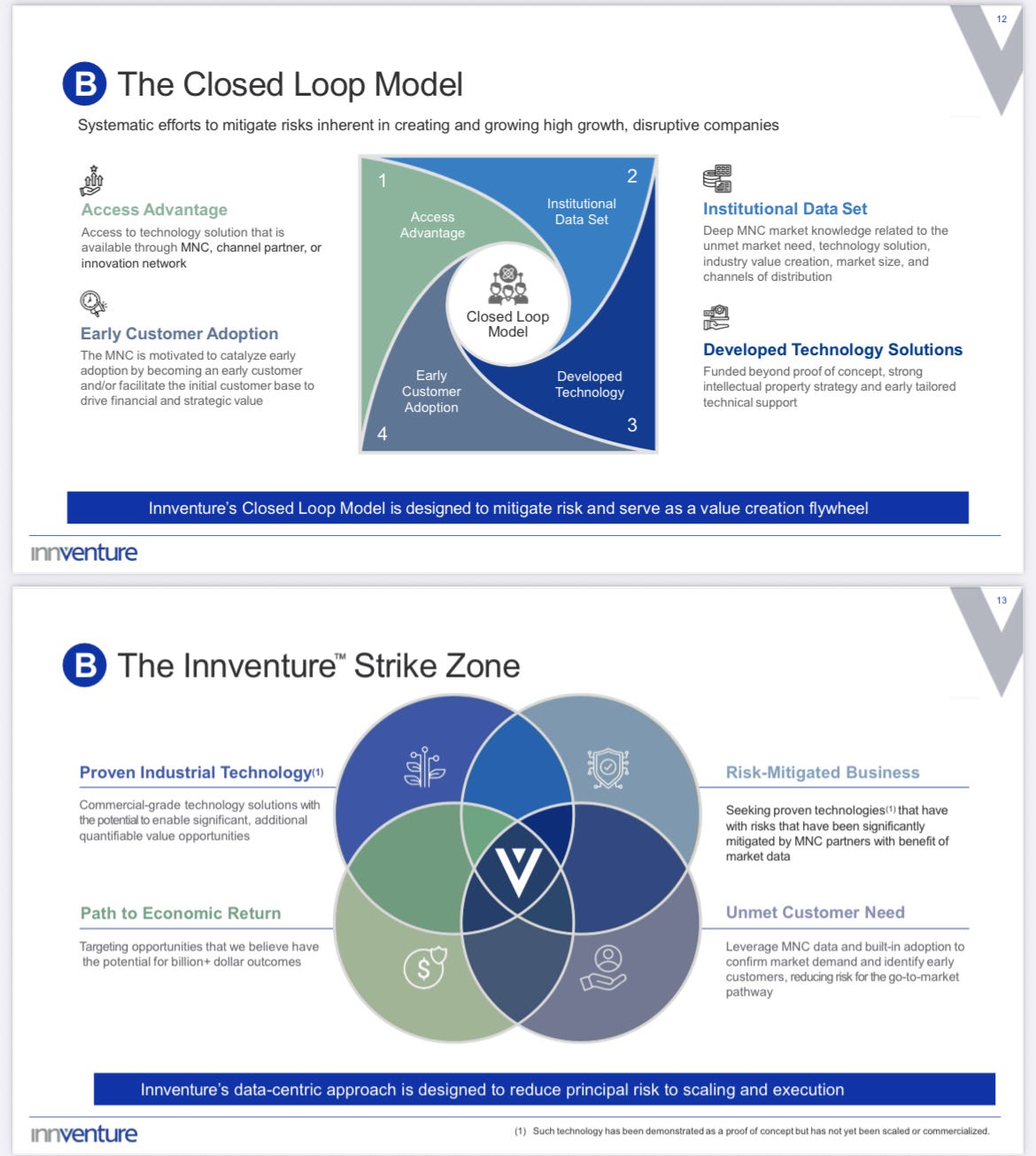

Innventure turns corporate R&D into standalone companies. They do not chase ideas randomly. Instead, they systematically find, vet, and scale proven technologies, mostly from multinationals like P&G and Nokia. The core of their approach is the Closed Loop Model.

An MNC identifies a pressing market problem, Innventure finds or validates a technology to solve it, and the MNC often acts as the first customer, helping the new company reach the market faster.

By early 2025, eight active MNC partners represented nearly $242B in combined enterprise value.

Keep reading with a 7-day free trial

Subscribe to Sophon Microcap Atlas to keep reading this post and get 7 days of free access to the full post archives.