Kaltura (KLTR) Initiating Coverage

Enterprise video platform positioned for AI-driven growth, with improving financials

Since launch, our goal with Sophon Microcap Atlas has been to build the definitive research hub for underfollowed sub-$500M companies. Each month we’re adding deep-dive coverage, proprietary scoring frameworks, and differentiated insights you won’t find anywhere else. With every report, the value of the platform compounds — but so does the subscription price.

We’ve structured it this way deliberately: to reward early adopters who believe in what we’re building. Subscribers who joined at launch are still paying their original rate, and they’ll keep that price for life. By contrast, new readers coming in today are already paying more than they did six months ago.

That’s by design. We’re investing heavily in research, and we want to keep the economics aligned with our most loyal readers.

When you join Sophon Microcap Atlas, your subscription price is locked in for life. We raise rates by $15 every two months to reflect the growing value of our research library, but early subscribers keep their lower rate forever. On November 1, the price rises to $60/month or $540/year — lock in now at $45/month or $400/year and you’ll still be paying that rate years from now, even when the service is worth thousands.

Not financial advice

View: Watchlist

Sophon Score: 78/100 (see evaluation rubric at end of note)

Kaltura presents a compelling long-term story. Its differentiated, enterprise-grade platform, accelerating subscription ARR, improving GMs, and consistent positive cash flow highlight strong execution. The AI-infused strategy and ability to consolidate fragmented video solutions provide clear competitive advantages, while per-customer ARR remains at record levels. Despite these positives, historical losses, execution risk in AI rollout, and competitive pressures warrant caution. We will hold off on initiating a position for now, but we view Kaltura as an attractive long-term opportunity and will revisit once we see sustained proof points of growth and profitability execution.

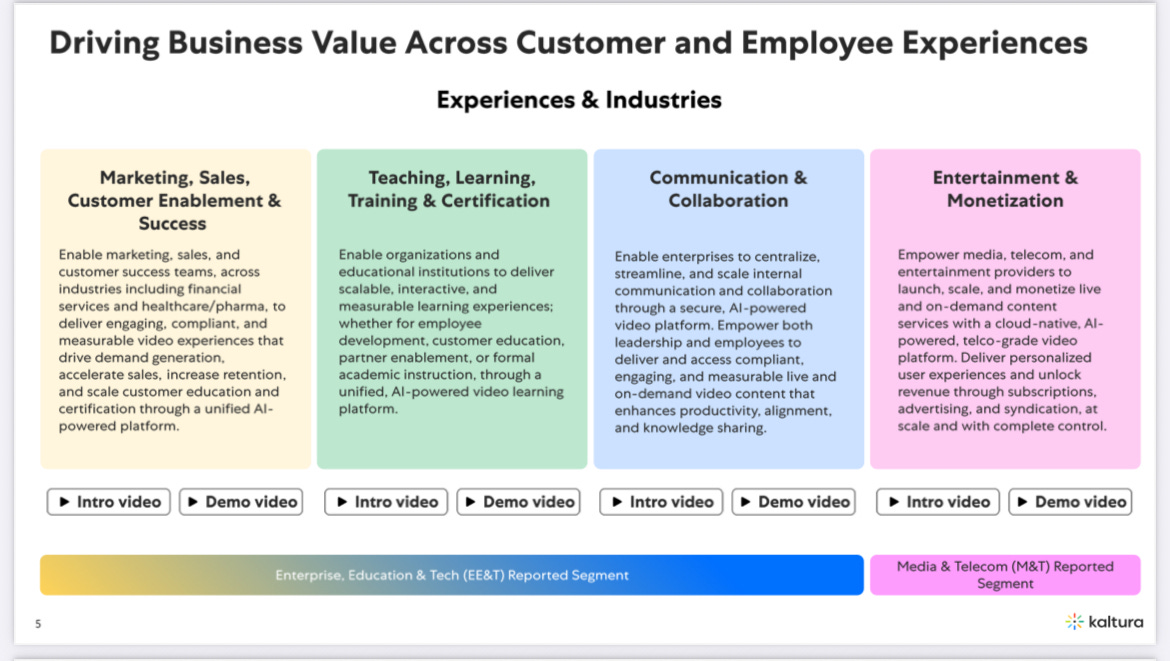

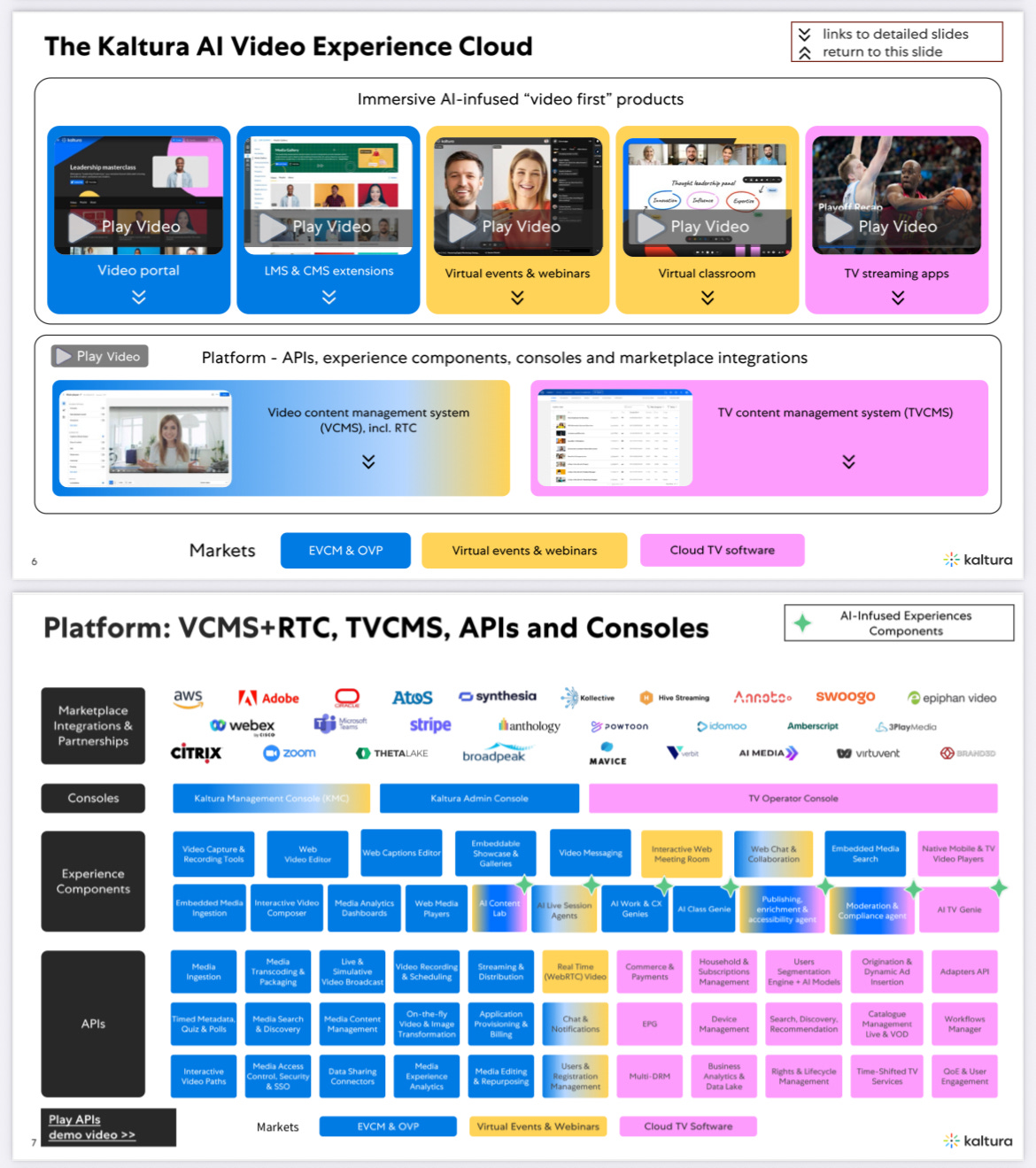

Kaltura is a SaaS and PaaS provider delivering a comprehensive video platform designed to power AI-infused, hyper-personalized video experiences for enterprises, educational institutions, tech OEMs, and media companies. Its platform spans live, real-time, and on-demand video, allowing organizations to consolidate vendors and reduce operational complexity. Kaltura integrates video into marketing, sales, training, internal comms, and other workflows.

The company differentiates itself from competitors through breadth and flexibility. Unlike Brightcove, which focuses on online video publishing for media, or Vimeo, which initially targeted virtual events, Kaltura offers a unified platform with a multitude of products covering enterprise video management, webinars, virtual classrooms, tech OEM, and media and telecom solutions.

Its API-first architecture, with over 800 APIs, enables deep customization and integration into customers’ tech stacks.

Kaltura serves a significant portion of Fortune 100 companies, top universities, and major financial institutions, and its platform supports management of events with hundreds of thousands of participants.

Strategically, Kaltura targets double-digit revenue growth and a “Rule of 30” by 2028 or sooner, a metric combining revenue growth and adjusted EBITDA margin. Its strategy leverages enterprise digital transformation trends and customer consolidation of fragmented point solutions onto unified platforms.

The company continues to expand and mature its portfolio in virtual events, webinars, and virtual classrooms while pursuing growth through upselling, cross-selling, new customer acquisition, and verticalization across industries such as financial services, pharma, technology, and education. Profitability and positive operating cash flow remain central objectives alongside top-line growth.

Keep reading with a 7-day free trial

Subscribe to Sophon Microcap Atlas to keep reading this post and get 7 days of free access to the full post archives.