Thunderbird Entertainment (TBRD.V) Initiating Coverage

Paying low single digit multiple on EBITDA for the next major global entertainment studio

Disclaimer: This is not financial advice and is intended for informational purposes only. Please do your own due diligence

View: Buy

Sophon Score: 81/100 (see evaluation rubric at end of note)

Thunderbird Entertainment represents one of the most attractive dislocations between fundamentals and valuation we’ve found in the public markets. It is truly “off the beaten path” due to its size, the specific market in which it trades, and the resulting illiquidity - which partly explains why it is available today as a compelling investment opportunity.

We believe Thunderbird represents a rare combination of:

Structural tailwinds in content production

Compelling valuation dislocation

A scalable model with a de-risked cost base

Strong cash flow visibility

Significant long-term operating leverage

Catalyst for multiple expansion (up-listing to a major exchange)

At current levels we believe Thunderbird has 5x upside and negligible downside. It represents the most asymmetric risk:reward set-up of any holdings in our portfolio, which is why we’ve sized it as our largest.

Thunderbird is a vertically integrated entertainment studio that produces animated, scripted, and unscripted content for global streaming platforms and broadcasters. Since its founding in 2003, the company has evolved from a traditional Canadian production house into a fully-fledged IP-driven media business with global reach. Its core strategy centers on building, owning, and monetizing IP across multiple revenue streams - licensing, consumer products, and video games - with a growing base of recurring revenues.

The stock has undergone a sharp multiple compression. At its peak in 2021, Thunderbird traded at ~15x EBITDA. Today, it trades at ~3x, despite continuing to deliver strong growth and profitability.

To contextualize how mispriced this is:

5-year revenue CAGR: ~21%

FY24 revenue growth: ~25% YoY

LTM EBITDA margins: ~15–30%

EV/EBITDA multiple: ~3x

We are paying 3x EBITDA for a company growing 20%+ top-line, with ~30% normalized EBITDA margins on a growing base of recurring revenues. In our view, that is an extraordinary setup.

Apart from the fact it is an illiquid microcap that trades on a minor foreign exchange, there are other reasons why we have the ability to buy Thunderbird at bargain prices, today. One is shoddy IR: mgmt acknowledged in their last earnings call that they haven't been able to “get out and tell our story” effectively to investors over the past couple of years. They are now planning to increase IR efforts.

Another factor is that the company screens sub-optimally due to “lumpy” financial results. The timing of owned IP project deliveries and revenue recognition can lead to non-linear results that can make the business appear less strong than it is. While recurring service work helps smooth results, the financials can still look choppy. Financials, however, are misleading. Thunderbird truly is a wonderful company with predictable long-term earnings.

The macro environment for content production remains highly constructive. Despite cost rationalization among major streamers, overall content budgets are still expanding:

Netflix is projected to spend $18 billion on content in 2025

Disney+ expects to grow its content budget 82% by 2027

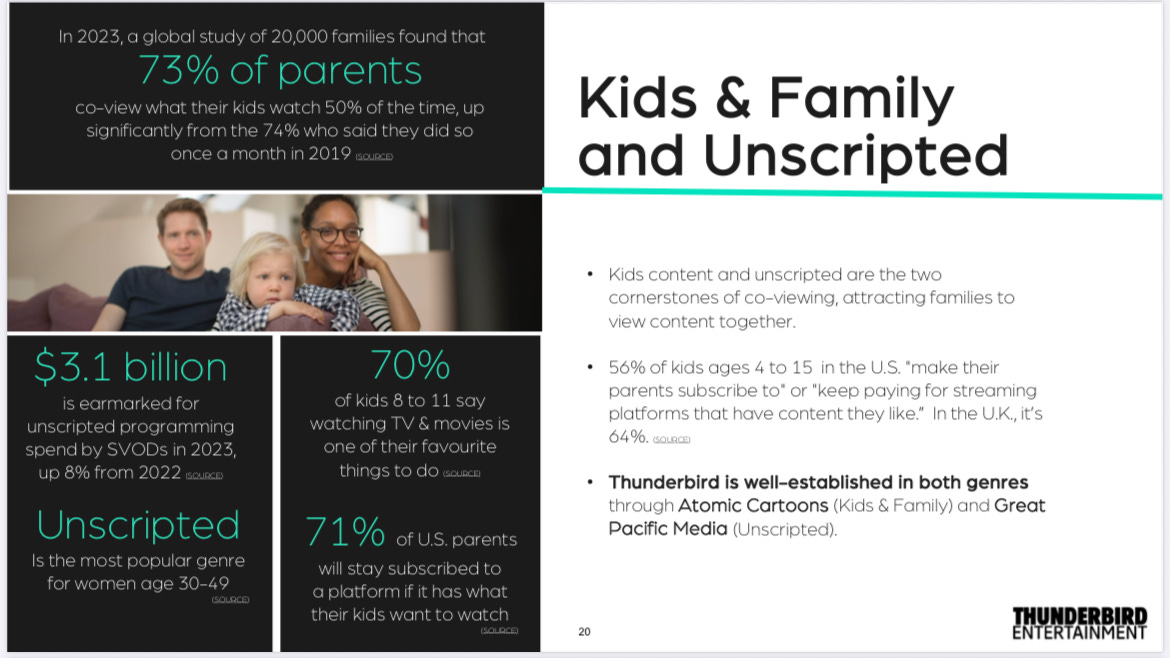

Unscripted content now accounts for nearly half of all original commissions across streamers

Thunderbird is directly positioned in these high-demand genres—particularly in Kids & Family and Unscripted - and maintains longstanding relationships with global distributors including Netflix, Disney+, Max, Nickelodeon, Apple TV+, NBCUniversal, CBC, and Discovery.

These partnerships are sticky, and the company frequently sees renewals of flagship franchises (e.g., Highway Thru Hell now in Season 14, Spidey and His Amazing Friends renewed for Season 5). Their production reliability and creative quality create a formidable moat.

Thunderbird operates a two-pronged model:

Production Service Work (~80% of FY24 revenue):

Low-risk, fee-for-service work where Thunderbird is hired to produce a show with costs fully covered by the client, plus a margin.

Primarily sourced from the animation division (Atomic Cartoons).

Provides steady, predictable cash flow and operating visibility.

Crucially, it functions as a lead-gen funnel for IP development: delivering quality on high-profile service work builds the credibility and trust needed to pitch and monetize their own IP.

Owned IP Development (~20% of revenue, but growing):

Thunderbird creates and owns the content outright and retains full monetization rights across formats.

EBITDA margins in owned IP are generally double those of service work (~30% vs. ~15%).

Monetization spans global licensing, consumer products, mobile games, and more.

The strategy is not to build a vast catalog, but to take a selective, high-quality approach aimed at consistent “singles,” reducing reliance on “home run” outcomes.

This operating structure combines the predictability of production services with the upside optionality of owned IP - providing downside protection and scalability.

Thunderbird benefits from a highly favorable cost structure enabled by Canada’s long-standing film and television production subsidies. These programs cover up to 75% of production costs through a blend of:

25% from Canadian Production Tax Credit (CPTC)

25% via Canadian Media Fund (CMF) broadcaster fees

Up to 40% from provincial tax credits (e.g., FIBC)

As of late 2024, the company noted effective rebates of ~35% for both service and owned IP work, with an additional 6% increase coming in 2025.

These credits can be monetized immediately via short-term production financing from Canadian banks, allowing Thunderbird to lock in financing and cost certainty before production begins. This dramatically reduces working capital requirements and protects the company from project-specific downside risk (i.e., “flops”).

Moreover, new regulations taking effect September 1, 2024, will mandate foreign-owned streaming services to contribute 5% of domestic revenue to Canadian industry funds - generating an estimated $200 million annually in incremental funding. This further solidifies the medium-term growth backdrop for content production in Canada.

Importantly, these tax credits have existed in various forms for 30+ years, across political regimes. Their political entrenchment and job creation benefits suggest low risk of rollback.

Thunderbird operates on a project-based hiring model, flexing its workforce up or down with production volume. This avoids fixed cost bloat and allows for efficient scaling.

Lastly, the company’s balance sheet profile also de-risks the company, with zero corporate debt, CAD 33.9 million in cash, resulting in capacity to internally fund growth and IP development.

In terms of catalysts for the company, a major one is its uplisting to the Toronto Stock Exchange. They are in the process of applying to the main TSX Board this year, which will increase visibility and should drive multiple expansion.

Thunderbird is our highest-conviction play. We eagerly await the company becoming the next global major studio, at which time more investors will be made aware of the name and will reasonably value its de-risked, recurring revenue/positive FCF-generating business model.

Sophon Score Breakdown

Market Opportunity – 9/10

Thunderbird is positioned in global content production, a multi-hundred-billion-dollar market, with secular tailwinds from streaming growth, especially in Kids & Family and Unscripted content. Revenue CAGR ~21% and streamer budgets expanding globally underscore large TAM.

Competitive Advantage – 8/10

Vertically integrated production studio with both service work (~80%) and owned IP (~20%) provides predictable cash flow while incubating scalable high-margin content. Sticky relationships with top-tier global distributors (Netflix, Disney+, Apple, etc.) and repeatable franchise renewals create meaningful moats.

Margins & Leverage – 8/10

EBITDA margins ~15–30% depending on segment; owned IP has ~30% margins. Canadian subsidies reduce effective costs by ~35%, lowering working capital needs and risk. Zero corporate debt and CAD 33.9M cash provides financial flexibility.

Reinvestment / Growth – 8/10

Selective owned IP development and ability to internally fund growth gives significant upside optionality. Expansion into global licensing, consumer products, and games provides multiple monetization channels. Uplisting to TSX could materially expand investor visibility.

Business Model Quality – 8/10

De-risked two-pronged model: predictable fee-for-service revenue plus higher-margin IP upside. Project-based workforce avoids fixed-cost bloat, making the model scalable and capital-light. Strong working capital profile due to advance production financing and tax credits.

Revenue Quality – 8/10

Recurring service contracts provide cash flow visibility. Owned IP segment growing with higher margins and monetization optionality. Lumpy delivery of IP projects may obscure short-term visibility but does not impair long-term predictability.

Pricing & Unit Economics – 8/10

Production subsidies, project-based cost flexibility, and IP monetization economics give strong unit-level profitability. EBITDA margins demonstrate operational efficiency across both service and IP segments.

Competitive Dynamics – 7/10

While content production is competitive, Thunderbird’s combination of scale, IP rights, distributor relationships, and Canadian subsidies provide structural advantages. Regulatory tailwinds (5% domestic revenue contribution by foreign streamers) reinforce sector positioning.

Management – 8/10

Experienced, founder-aligned leadership with disciplined capital allocation. Strategy balances recurring service stability with selective IP upside. Focus on expanding IR efforts and uplisting shows proactive value creation.

Financial Health – 9/10

Zero debt, CAD 33.9M cash, low working capital requirements due to subsidies and financing. Strong free cash flow supports reinvestment, growth, and optionality. Robust balance sheet provides downside protection.

Total Sophon Score: 81 / 100

Thunderbird Entertainment screens as a high-quality, capital-light, scalable content production business with de-risked cash flow and significant upside optionality. The combination of recurring service revenue, owned IP upside, operational leverage, tax/subsidy tailwinds, and a potential uplisting creates an asymmetric risk-reward profile, making it a high-conviction microcap opportunity.